Concordium Town Hall 2 — Commercial Focus & Stablecoin Ecosystem Expansion

April 24, 2025 - Summary and Comments

Hosts

- Boris Bohrer-Bilowitzki (CEO)

- Mike Milner (CCO)

- Peter Marirosans (CTO)

- Varun Kabra (CGO)

Guests

- Andrew MacKenzie, Agant (GBPA)

- Arpan Gautam, Noon (USN)

- Julien Bahurel, Deep Blue (DBUSD)

- Borja Burguillos, AEDX (AEDX)

TL;DR

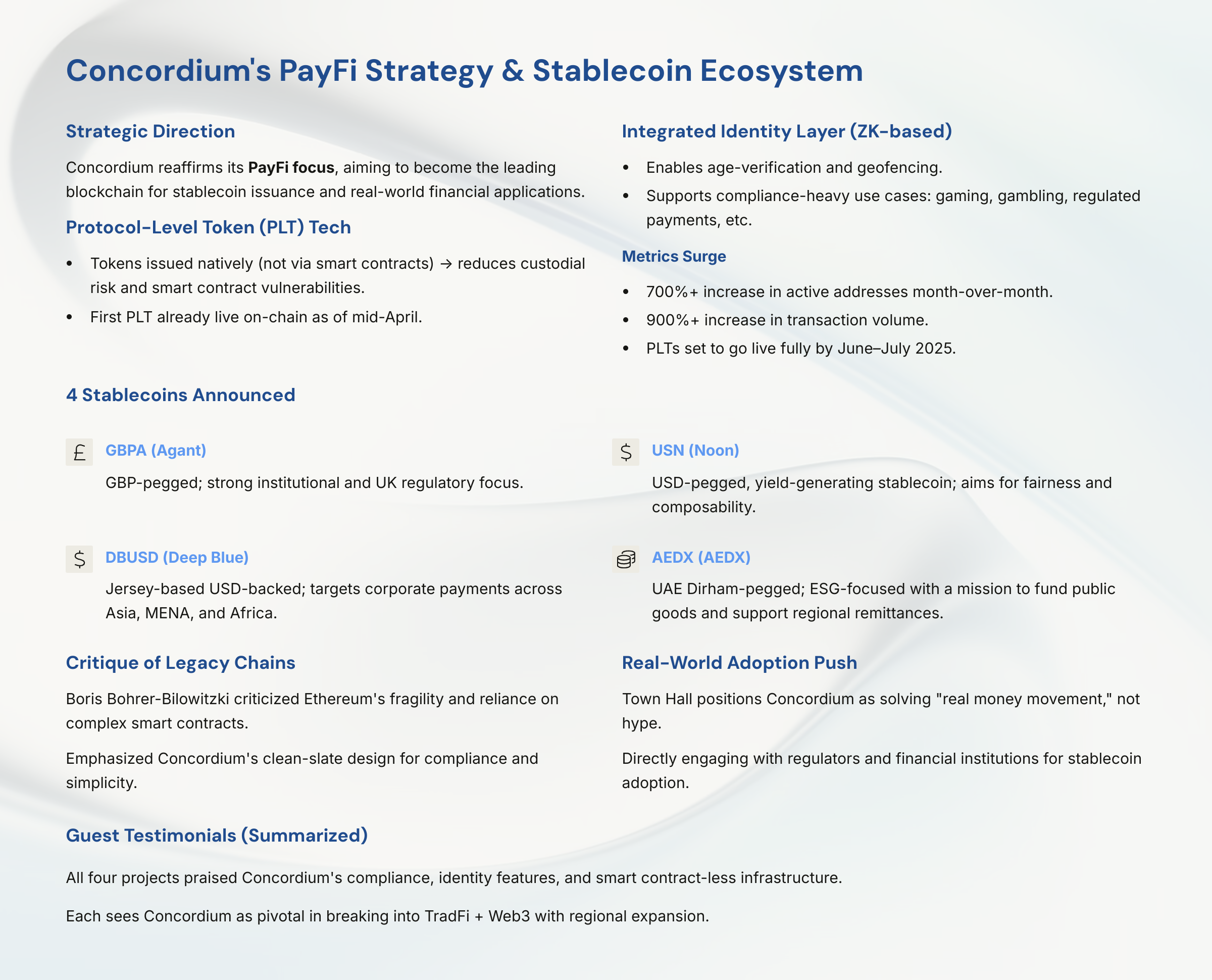

1 Why Concordium is Doubling Down on Stablecoins

Opening Remarks by CEO Boris Bohrer-Bilowitzki

- Welcomes everyone to the second Town Hall since the project’s strategic relaunch.

- Re-introduces the new leadership team:

- Mike Milner – Chief Commercial Officer (CCO)

- Peter Marirosans – Chief Technology Officer (CTO)

- Varun Kabra – Chief Growth Officer (CGO)

A Rebooted Vision for Real-World Utility

- Criticizes the crypto space for failing to deliver on its original promise.

- Rejects the hype-driven culture of memecoins and artificial pumps.

- Reaffirms commitment to Satoshi’s original vision: peer-to-peer global digital cash.

- Positions payments as the true killer use case for blockchain.

New Strategy Signed Off in Late January

- Current strategy is ~60 days into execution.

- Built around both existing features and an expanded roadmap.

- Stablecoins are at the center of the new direction.

- Concordium is actively in talks with most major stablecoin issuers.

Early Market Validation

- “Holy shit” moment: Concordium’s feature set is resonating with issuers.

- Four stablecoin projects (Agant, Noon, Deep Blue, AEDX) have already committed.

Tech Milestone: First PLT Created

- Concordium successfully created its first Protocol-Level Token (PLT).

- PLT issuance happens at the core layer, not via smart contracts.

The World Is Starting to Get the Narrative

- Concordium’s identity-first + compliance-ready story is gaining traction.

- Market interest isn’t just hype—early metrics are up massively:

- Addresses: +700% MoM

- Fees & CCD usage: +400% MoM

- Transactions: +900% MoM

- All before PLTs go live — expected June/July 2025.

Comments

https://t.me/c/1659427635/29147

2 Concordium’s Tech Backbone: PLTs & Protocol Upgrades

60 Days, Major Progress

- Peter Marirosans reflects on the intense pace since the strategy launched 60 days ago.

- Notes it’s been “very busy, to say the least.”

Protocol 8: Live and Functional

- Protocol 8 successfully launched.

- Introduced the ability to suspend underperforming validators.

- Immediate result: a more secure and stable chain.

Protocol 9: PLT Infrastructure Activated

- Sets the stage for native Protocol-Level Tokens (PLTs).

- First PLT already live on the Concordium ledger — not via smart contract.

- A key milestone in Concordium’s shift toward smart contract-less, compliant digital assets.

No SaaS, No Easy Patches

- Emphasizes that Concordium is not a SaaS app—no quick server patches.

- Every change is deep protocol work, involving major releases.

- Three major releases planned — and so far, the team is delivering.

Comments

https://t.me/c/1659427635/29148

3 Strategic Updates from CCO Mike Milner

More to come

- Mike opens by confirming he’ll lead the stablecoin segment.

- Expect a deep dive into four new strategic partners coming shortly.

Infrastructure Progress Since Last Town Hall

- BitMart now live — expands Concordium’s exchange presence.

- Bitpanda also live — adds a major European fiat on-ramp.

- Luganodes joined Concordium’s staking infrastructure:

- Enhancing validator performance and institutional trust.

Comments

https://t.me/c/1659427635/29149

4 Branding, Narrative & Visibility — Varun Kabra (CGO)

Web3 Runs on Narratives

- Emphasizes the importance of strong positioning.

- Concordium is gaining traction as a “PayFi” brand — the most powerful emerging narrative in Web3 right now.

New Website Launched

- New site is now live — a key ask from the last Town Hall.

- It’s a fluid platform — will continue to evolve over time.

Influencer & Media Push Paying Off

- Despite being a small brand, Concordium’s team is:

- Activating press

- Driving influencer engagement

- Early signs of increased visibility across the space.

Comments

https://t.me/c/1659427635/29150

5 Why Stablecoins? Why Now? — Boris’s Vision for PayFi

We Failed as a Space

- Boris says crypto lost its way, chasing hype, memes & complexity.

- Real-world adoption of blockchain never truly happened.

- Time to reclaim Satoshi’s vision: real digital cash, used—not just talked about.

Payments Need to Be Invisible

- Blockchain must be used, not understood.

- Everyday people “don’t have a scooby” how money moves — and that’s OK.

- We’ve made things too complex. Simplify. Focus. Deliver.

Ethereum & the Fragility of Smart Contracts

- Acknowledges Ethereum’s contributions but criticizes:

- Custodial smart contracts = a disaster waiting to happen.

- Calls out massive failures like ByBit: $1.5B lost.

- Quotes Charles Hoskinson saying Ethereum may not be around in 10 years.

Concordium’s Edge: PLTs + Privacy-Preserving Identity

- Native issuance (PLT) = no smart contract risk.

- Smart contracts should enforce rules, not hold funds.

- ZK-based identity layer enables:

- Age-verified payments

- Geofencing

- Tokenized financial instruments with built-in compliance

Stablecoins Are Exploding

- Market grew $5.3B in Q3 2024 (+3.2%)

- YTD growth: +28%

- USDC jumped from $36B to $61B

- Traditional banks now entering the stablecoin arena

Real World + Web3 = True Adoption

- Goal: stablecoins used off-chain and on-chain — not just dumped to buy BTC.

- Concordium = bridge between crypto-native and TradFi use cases.

Concordium is First — But Not Last

- Big players can’t rebuild their stack the way Concordium can.

- PLTs + identity = first-mover advantage for institutional-grade stablecoin infra.

- “We’re not Ethereum. Nobody bloody knows us—yet.”

Market Fit Confirmed

- f“You hope your strategy hits… and this week it did.”

- Four first-movers (Agant, Noon, Deep Blue, AEDX) saw the vision and jumped in.

- Concordium now solving real needs that no other chain could fulfill.

Building the Financial Rails of the Future

- Stablecoins as programmable, compliant digital cash.

- Proof of age, geography, KYC — all possible without leaking identity.

- “This is much bigger than the $2.8T crypto market cap.”

“Don’t take my word for it…”

- Invites the four strategic partners to speak next.

- Declares: “This is the birth of something proper.”

- Working 18–19 hours a day to deliver the future of smart money.

Comments

https://t.me/c/1659427635/29151

6 Stablecoins: The Real Use Case — Mike Milner’s Panel Kickoff

Welcome to the Strategic Partner Panel

- Mike welcomes global audience to the panel discussion.

- Focus: the evolving stablecoin landscape, obstacles to adoption, and real-world use cases.

- Emphasis on how Concordium and its new partners are breaking down barriers for non-Web3 adoption.

Quick Chain Recap — Grounding the Discussion

- Stablecoins have huge potential, but adoption hurdles remain.

- Concordium’s goal: Grow the pie by onboarding new money from TradFi, Web2, and Main Street.

- Not just fighting for market share with Ethereum, Solana, etc.

Two Unique Concordium Features That De-risk Adoption

1) Identity Layer: ZK-Powered Compliance

- Integrated at the protocol level, not an add-on.

- Enables real-world features:

- Age-verified payments (e.g., 18+ or 21+ by jurisdiction)

- Geofencing of tokens (limit distribution by region/nationality)

2) Protocol-Level Programmability

- Unlike other chains, Concordium programs payments at the base layer—not via vulnerable smart contracts.

- Real-world implication:

- Schedule and lock payments directly on-chain.

- Removes tradeoff between either accepting counterparty risk or smart contract risk for recurring/multi-leg transactions.

Core Insight

- Most blockchains promised programmable money.

- Reality? People just programmed custodial smart contracts, exposing funds to hacks.

- Concordium flips that model: native, secure, compliant digital cash.

Meet the 4 Strategic Stablecoin Partners

- 🇬🇧 Andy (Agant – GBPA)

- Founder/CEO of Agant

- Issuing GBPA: GBP-pegged stablecoin

- Goal: modernize GBP settlement rails

- 🇺🇸 Apen (Noon – USN)

- Founder/CEO of Noon

- Issuing USN: yield-generating USD stablecoin

- Focused on next-gen programmable finance

- 🇯🇪 Julien (Deep Blue – DBUSD)

- Cofounder/CEO of Deep Blue

- Jersey’s first dollar-backed stablecoin

- Targets cross-border remittances and institutional payments

- 🇦🇪 Boha (AEDX – AEDX)

- UAE-based project

- Issuing AEDX: Dirham-pegged stablecoin

- Designed to enhance financial inclusion and support local economy & public goods

Comments

https://t.me/c/1659427635/29152

7 🇬🇧 Andrew Mackenzie (Agant) — GBPA & the Rise of Non-USD Stablecoins

Why GBPA? Why Now?

- Founded Agant just over a year ago.

- Sees 2025 as the year for non-USD stablecoins.

- Non-USD stablecoins have grown +115% since January 2025.

- Momentum is accelerating outside the dollar sphere.

Why Concordium?

- Institutional adoption is the key driver:

- Institutions won’t touch untrusted rails.

- Need compliance, identity, and counterparty certainty.

- Concordium offers:

- Protocol-level issuance — eliminates smart contract risks.

- Integrated identity layer — especially relevant for UK compliance use cases.

Core Insight

“Institutions won’t move money onto rails they can’t trust. Smart contract risk and regulatory uncertainty are deal-breakers.”

Comments

https://t.me/c/1659427635/29153

8 🇺🇸 Apen (Noon) — Building the Most Intelligent & Fair Stablecoin (USN)

Background & Journey to Noon

- Started in TradFi: McKinsey, Goldman Sachs

- Built a digital bank in the UK

- Transitioned to Web3: helped scale a prop trading firm (trillions/year)

- Frustrated with hype cycles — wanted to build something value-aligned

Noon’s Mission: Redefining Stablecoins

- Most Intelligent Stablecoin:

- Offers safest, highest yield through market cycles

- Aims to make yield-bearing assets the new reserve currency

- Most Fair Stablecoin:

- No VCs, no influencers, no external cap table

- Self-funded → returns value to users, not insiders:

- 90%+ raw returns go to users

- 80% of governance tokens are user-distributed

Where They’re At

- Public beta just launched

- Already at $25M–$30M TVL

- Rapid growth expected with Concordium’s support

Core Insight

“We’re not just building a stablecoin. We’re trying to reset the game — on both yield and fairness.”

Comments

https://t.me/c/1659427635/29154

9 Julien (Deep Blue) — DBUSD & Stablecoin Solutions for Corporates

Background & Entry into Crypto

- Career in equity derivatives trading

- Entered crypto in 2022

- Co-founded Deep Blue in 2023 to bring enterprise-grade stablecoin solutions

Deep Blue’s Focus

- Not just a stablecoin, but a complete financial solution

- Built for corporates across:

- Asia

- Middle East

- Africa

- Use cases:

- Cross-border remittances

- Global payments

- Treasury management tools

Why Concordium?

- Long-standing relationship with the team

- Attracted by Concordium’s programmability + risk mitigation

- Focused on:

- Eliminating counterparty and technical risk

- Automating finance operations

- Ushering in Stablecoin 2.0

Core Insight

“The future of stablecoins is smart, safe, and enterprise-ready — built for $600T of traditional finance, not just the $2.8T crypto bubble.”

Comments

https://t.me/c/1659427635/29155

10 🇦🇪 Borja (AEDX) — Dirham-Pegged Stablecoin for Financial Inclusion & Social Impact

MENA-Based, Mission-Driven

- Founder of AEDX, based in Dubai, UAE

- Initiative focused on bringing stability + financial access to the MENA region

What Is AEDX?

- UAE Dirham–pegged stablecoin

- Designed to serve:

- Middle East & North Africa

- Everyday financial needs

- Cross-border and local economic development

Mission: Stablecoins for Good

- AEDX isn’t just a financial tool — it’s a platform for positive change

- Reinvests a significant share of revenue into social causes

- Support for people with disabilities

- Broader community aid and inclusion programs

Why Concordium?

- Chose Concordium for its:

- Protocol-level ID layer

- Built-in compliance and accountability

- Concordium’s approach is ideal for MENA’s regulatory sensitivity:

- Supports mainstream acceptance through ZK-enabled compliance.

Core Insight

“Financial innovation must carry responsibility. AEDX is stablecoin infrastructure designed not just for efficiency, but for impact and inclusion.”

Comments

https://t.me/c/1659427635/29156

11 GBPA’s Institutional Edge — Andrew on Concordium’s Role in UK Adoption

Fintech First, Crypto Second

- Agant sees itself as a Fintech using blockchain, not a “crypto project.”

- UK regulators want innovation that strengthens financial infrastructure, not another Tether clone.

Concordium Solves Real Institutional Problems

- Smart contract risk is a no-go for:

- Banks

- Pension funds

- Asset managers

- Concordium’s protocol-level tokens eliminate this exposure.

- Native compliance + programmability = door-opener for TradFi adoption

Identity Layer Matters for Both Sides

- Institutions benefit from built-in compliance guarantees.

- Retail use cases benefit from certainty:

- Helps apps verify user identity and age, e.g., for age-restricted products.

- Especially relevant for UK’s younger, digital-native audiences.

Concordium = Regulatory + Adoption Enabler

“It’s not just a tech choice. It’s a regulatory enabler that turns institutional interest into real-world adoption.”

Core Insight

“Risk departments won’t accept smart contract exposure. Programmable logic must be native and secure — not outsourced to third-party code.”

Comments

https://t.me/c/1659427635/29157

12 Apen on Noon + Concordium — Unlocking Yield-Bearing Stablecoin Adoption

Why “Intelligence” Matters at Noon

- Noon’s goal: create the most intelligent stablecoin

- Meaning: a safe, yield-bearing, liquid asset accessible to everyone

- Designed to challenge the global norm of fiat as the default “reserve currency”

Social Impact Through Yield Access

- Big gap: corporates and HNWIs have dual-class assets (yield + liquidity)

- Retail users? Forced into cash and lose to inflation

- Noon’s mission: narrow the wealth gap with accessible yield-bearing money

Why Concordium Is the Ideal Partner

- PLT infrastructure, ZK identity, and regulatory readiness make Concordium:

- Secure

- Institution-friendly

- A base-layer solution for real-world stablecoin payments

- Concordium’s holistic design allows Noon to:

- Plug into TradFi rails

- Integrate with banks and neobanks

- Reach emerging + developed markets with safe, compliant tools

Core Insight

“Noon can be a game-changer — but only if banks and real-world channels can access it safely. Concordium makes that possible.”

Comments

https://t.me/c/1659427635/29158

13 Julien on DBUSD — Making Global Payments Simple & Programmable

Problem: Moving Money Is a Nightmare

- Global businesses face massive complexity:

- Multiple jurisdictions

- Many currencies

- Recurring cross-border transactions

- Internal transfers, payroll, remittances, CapEx, etc.

- Result: Costly, slow, manual money workflows that distract from core business

Deep Blue’s Mission

- Make money T+0, atomic, frictionless

- Build programmable infrastructure for:

- Payroll

- Affiliate payouts

- CapEx/Opex

- Treasury ops

Why Concordium?

- Programmability at the money level (via PLT), not via smart contracts:

- Reduces complexity

- Avoids smart contract risk

- More intuitive for TradFi teams

- Businesses are reluctant to trust smart contracts, even when audited

Core Insight

“Traditional businesses don’t want to trust smart contracts. But they’ll trust programmable money that’s secure at the protocol level.”

Comments

https://t.me/c/1659427635/29159

14 Borja on AEDX — Enabling Licensing, Local Currency Push & ESG in MENA

Why AEDX Exists — Tackling 4 Major Regional Challenges

- 1️⃣ UAE as a Growing Trading Hub

- Local gov’t wants to increase AED usage in trade, not just rely on USD

- 2️⃣ Geostrategic Risk

- Over 99% of stablecoin trading is in USD

- UAE (and others) need alternatives for sovereignty and resilience

- 3️⃣ Massive Remittance Outflows

- UAE has large expat population → heavy capital outflow

- AEDX can digitize and optimize remittances

- 4️⃣ Weak ESG Track Records

- AEDX aims to uplift regional ESG reputation through social good reinvestment

Why Concordium Is the Enabler

- Concordium’s protocol-level ID layer is crucial:

- Helps satisfy UAE regulators on AML/KYC compliance

- Eases the licensing process for launching stablecoins

- Offers unmatched regulatory comfort for both UAE and future regions

Vision Beyond UAE

- AEDX plans to expand regionally across:

- MENA countries

- CIS markets

- Concordium’s scalability + security are essential for:

- High transaction volumes

- Sustained compliance across jurisdictions

Core Insight

“Concordium is the only chain today offering the full stack needed to pass regulatory scrutiny for stablecoins in the UAE — and soon, the wider region.”

Comments

https://t.me/c/1659427635/29160

15 Andrew (AGANT) on Biggest Adoption Blockers in the UK

Compliance + KYC Fatigue

- Two key frictions:

- 1. Regulatory inertia — applications taking over a year

- 2. Institutional caution — nervousness around unclear compliance paths

- “Some firms applied in Feb 2023 and are still waiting.”

How Concordium Helps

- Programmable money + ID layer = trusted tools for:

- Geofencing

- Age/status checks

- Travel rule compliance

- Makes compliance clearer and execution easier for institutions

Message Is Getting Through

- Proactively engaging regulators: “How can we innovate compliantly?”

- Institutional partners respond positively to:

- Concordium’s compliance stack

- Concordium’s approach to programmable, trusted money

Core Insight

“It’s not just the rules — it’s the lack of clarity. Concordium helps us bring compliance into the conversation, not dodge it.”

Comments

https://t.me/c/1659427635/29189

16 Apen (Noon) on Biggest Adoption Blockers

Regulation and KYC are real blockers

- KYC hurdles and slow regulatory approvals are major obstacles.

- These are critical issues for both institutional and stablecoin adoption.

The bigger challenge is usability

- Mass adoption means retail adoption—not just crypto insiders.

- The average person still lacks an easy, compelling use case for stablecoins.

- Blockchain is too complex. If people need to understand it to use it, it won’t scale.

What users actually want

- One-click buy. One-click sell. On their phone.

- Not wallet creation, DApp navigation, swaps, or yield strategies.

- Usability must improve drastically.

Stablecoins can’t fix this alone

- Need ecosystems that abstract away the technical layers.

- Blockchains must focus on simplicity, especially around payments.

- This is where Concordium has an edge: single-minded focus on making payments and compliance seamless.

Core takeaway

“Condense the stack. Remove friction. Deliver simplicity.”

Comments

https://t.me/c/1659427635/29190

17 Julien (Deep Blue) on Biggest Adoption Blockers

1. Education and simplicity

- Most businesses still don’t understand stablecoins.

- They see risk, not opportunity.

- Simplicity is critical. Complex tools don’t get used.

2. Regulation vs. permissionlessness

- We need regulatory frameworks to access real capital.

- But money must also flow freely to be useful.

- The line between over-regulation and full decentralization is subtle—and essential to get right.

3. Clear use cases

- Adoption won’t come from hype.

- Users need to see real advantages—cheaper, safer, faster.

- The industry must demonstrate tangible benefits, not just new on-ramps or buzzwords.

Comments

https://t.me/c/1659427635/29191

18 Borja (AEDX) on Biggest Adoption Blockers

1. Trust is foundational

- Mass adoption starts with institutional trust.

- Financial institutions and governments must support the infrastructure.

2. Regulatory clarity is coming

- Believes the next 24 months will bring clearer, more comprehensive frameworks.

- Many countries are actively working on regulation right now.

3. Seamless integration is everything

- People don’t care what they pay with—only that it works.

- Stablecoins need to plug into the financial system invisibly.

- Success depends on ease of use, not novelty.

Final takeaway

- This is shaping up to be blockchain’s first real mass-market use case after Bitcoin. The infrastructure is catching up, and Concordium is helping lead that transition.

Comments

https://t.me/c/1659427635/29192

19 Andrew (GBPA – Agant) on 2025 Roadmap

Top priority

- Launch and go live.

- Regulatory clearance is the gating factor—can’t just ship at will.

- Once approved, aim is to get GBPA circulating in the UK financial system.

Key focus areas

- FX on-chain — especially GBP/USD (Cable), one of the world’s most traded pairs.

- Remittances — unlocking faster, cheaper GBP transfers.

- ID-layer integration — exploring advanced identity-based use cases with Concordium.

Core message

“Getting to market is step one. Then we scale into FX, remittances, and real institutional use.”

Comments

https://t.me/c/1659427635/29193

20 Arpan (Noon) on 2025 Roadmap

Short-term

- Public beta live.

- Current TVL around $25 million.

- Goal: grow TVL by several multiples in the next few months.

Medium-term

- Governance token launch (TGE) targeted for late Q2 or early Q3.

- Focus on real value sharing with governance token holders.

- Aims to set a new standard for fairness and democratization in stablecoins.

Long-term

- Broad global distribution of yield-bearing stablecoins.

- Focused heavily on payments adoption.

- Seamless integration into everyday financial transactions.

- Partnership with Concordium seen as crucial to achieving this goal.

Core message

“Grow utility now, democratize governance mid-year, and enable global payment adoption over time.”

Comments

https://t.me/c/1659427635/29195

21 Julien (DBUSD – Deep Blue) on 2025 Roadmap

Short-term goal

- Onboard 12–15 real corporate users.

- Deliver meaningful value:

- Save them time.

- Save them money.

- Focus is on making stablecoins a true solution, not just a payment rail.

Medium-to-long-term vision

- Enable complex recurring payment use cases.

- Example: enterprise-grade solutions for companies like Netflix.

- Goal: demonstrate real-world, scalable business utility for stablecoins via Concordium.

Core message

“If real companies come back and say: ‘DBUSD saved us time and money’— that’s the milestone.”

Comments

https://t.me/c/1659427635/29196

22 Borja (AEDX) on 2025 Roadmap

Near-term priorities

- Secure regulatory pre-approvals and full licensing in the UAE.

- Establish strategic integrations with:

- Major financial institutions

- Multinational corporations

- Concordium’s ID layer is a key enabler for meeting strict compliance demands.

Mid-to-long-term vision

- See companies actively trading and holding AEDX as part of treasury management.

- Enable migrant workers to send AEDX home for remittances.

- Support everyday retail use—paying for groceries, cabs, daily expenses.

Target timeline

- Real-world adoption in place by end of 2025 / early 2026.

Comments

https://t.me/c/1659427635/29197

23 Stablecoin Panel - Mike Milner's Closing Remarks

Main point to the audience

- What excites Mike about these four partners is that they are not just aiming for DeFi-native uses like:

- Yield farming on Aave

- Collateralizing derivative positions

- The panelists are focused on real-world adoption:

- Where crypto and traditional finance actually intersect

- Where stablecoins are used for real-world payments, remittances, and business transactions

Comments

https://t.me/c/1659427635/29198

24-39 Q&A 1-17: Summary Available on Request

Contact Concordium Validator 85223 to request access to the summary of this section of the town hall.

40 Big Audience and Developer Announcements

Huge interest in the Town Hall

- It's confirmed that there were about 45,000 viewers during the session.

- Boris Bohrer-Bilowitzki thanks the team and the new stablecoin partners for helping boost attention.

- Highlights that the surge is tied to the announcements of the last 48 hours.

Launch of DevNet

- Concordium introduces a new DevNet environment alongside StageNet, TestNet, and MainNet.

- DevNet allows early stablecoin issuers to experiment with the new payment rails and PLT functionality.

Strategic Approach and Philosophy

- Focus on Building with the Market

- Concordium refuses a “my way or the highway” approach.

- Believes lasting success comes from working with the market, not dictating to it.

- Emphasizes continuous feedback loops from real users and partners.

- Commitment to Partners

- Concordium pledges not just to deliver tech, but to actively help partners succeed.

- Any future partners will be treated with the same level of support and seriousness.

Focus on Protocol-Level Tokens (PLTs)

- PLTs are issued natively on Concordium’s layer-1 protocol.

- No reliance on rollups or external smart contracts.

- Purpose is to simplify, secure, and strengthen issuance directly at protocol level.

Testing and Expansion Plan

- Four stablecoin partners already onboard for DevNet testing.

- More issuers are expected to join between now and June 2025.

- Testing covers features like payment processing, scheduled transfers, and geofencing.

Message to the Community

- Boris emphasizes that DevNet is a major milestone for Concordium’s roadmap.

- Asks the community to stay engaged as more progress and new partners are announced.

Comments

https://t.me/c/1659427635/29259

41 What will be Tested on DevNet

DevNet Testing Focus

- Core features being tested:

- Verify and Buy

- Verify and Pay

- Scheduled Transfers

- Geofencing and more

- Goal: Tighten everything before Mainnet rollout.

Broader Ecosystem Involvement

- Use case developers (beyond stablecoins) start testing next week.

Real feedback will come from both issuers and ecosystem players.

Developer Growth and Strategic Importance

- 850% developer growth ties directly to this structured approach.

- While less visible to the public, this is crucial to hitting major targets.

Comments

https://t.me/c/1659427635/29260

42 Liquidity Improvements and GSR Partnership Announcement

Liquidity Problem Fixed

- Liquidity was historically weak, tied to Concordium’s early identity focus.

- New strategy flipped the situation toward real-world payment adoption.

- Top-tier market maker GSR signed to manage liquidity.

- GSR is highly selective and only works with serious projects.

- Liquidity provisioning has already started.

Importance of GSR Partnership

- Ensures stronger trading environment across future venues.

- Validates Concordium’s upgraded strategy in the eyes of serious market players.

- Personal thanks given to key GSR contacts for supporting the partnership.

Ongoing Focus on Ecosystem Expansion

- Liquidity is just the first step — more venue access initiatives coming.

- Community also encouraged to help push for broader exchange listings.

Closing Community Updates

- Last 48 hours confirmed strategic direction is correct.

- Many developments ahead — some less flashy but crucial, others highly exciting.

- Mike, Boris, and team will attend Token 2049 in UAE — community invited to say hi.

Comments

https://t.me/c/1659427635/29261

43 Closing Reflections and Community Thanks

Reflections on Progress Since Town Hall 1

- Initial fears about overpromising and wrong positioning were proven wrong.

- Confidence reaffirmed by the strong features and clear market need.

Industry Critique

- Boris criticized how blockchain has evolved: too complex, not solving real-world problems.

- Emphasized that Concordium focuses on use, not on abstract complexity.

- Industry has largely failed to deliver real-world adoption after 11–12 years.

Vision for Concordium

- Focus remains on building what the world actually needs, not on hype cycles.

- Positive reception from media and institutions confirms strategic direction.

- Concordium aims to fulfill the original promise of blockchain technology.

Gratitude Toward Early Partners and Supporters

- Special thanks to the first four stablecoin partners for their leap of faith.

- Recognition of the OG community members who stayed loyal despite difficult market conditions.

- Welcome extended to newcomers discovering Concordium’s new direction.

Team Growth and Execution Speed

- Concordium team now exceeds 70 people, working at high speed.

- Remarkable progress made in just 60 days since the new strategy rollout.

Final Message to Community

- Encouragement to stay alert for many upcoming developments.

- Acknowledgement that while some may watch skeptically, major progress is underway.

- Thanks to everyone for their belief, energy, and continued support.

Comments: