Messari Deep Dive: Why Identity and Trust Will Reshape On-Chain Finance

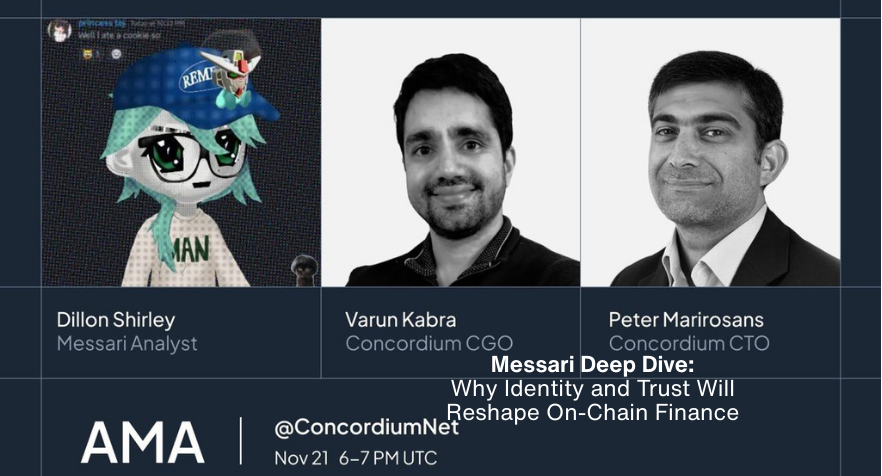

Concordium participated in a Messari Deep Dive on 21 November 2025, featuring Varun Kumar and Peter Marirosans, exploring Concordium’s architecture, strategic direction, and long-term vision.

The discussion covered protocol-level identity, PLTs, deterministic finality, PayFi, regulation, and the roadmap ahead. The session delivered deep insights and serves both as a solid refresher for those familiar with Concordium and as a strong starting point for readers new to the project.

Below is a structured summary of the conversation, organized by topic and distilled to highlight the key insights shared during the session.

1 What Concordium Is and Why It Exists

Section 1 What Concordium Is and Why It Exists

0:00

/281.82

- Founding and nature of Concordium

- Concordium is a research-based layer-1, PayFi blockchain.

- Founded by Lars Seier, also known for founding Saxo Bank.

- Name comes from Latin “Concordia”, meaning harmony and agreement.

- Name reflects the chain’s purpose: embedding trust into every interaction.

- Why most L1s fail for real-world use

- Lack of identity frameworks.

- Unpredictable transaction costs, especially problematic for Web2 businesses.

- Lack of compliance readiness for real-world adoption.

- Heavy reliance on insecure smart contracts as a systemic design flaw.

- What Concordium offers instead

- Identity layer at the protocol level.

- Ability to issue stablecoins on-chain, not through smart contracts.

- Deterministic fees (predictable for businesses).

- Design goal is security + identity integration without smart-contract honeypots.

- Peter’s technical confirmation

- Identity is native at protocol level, not bolted on.

- No smart contracts involved in verifying identity or credentials.

- Avoids smart-contract honeypots entirely.

2 Concordium’s Origins and Strategic Shift

2 Concordiums Origins and Strategic Shift

0:00

/206.475011

- Lars Seier Christensen’s original foundation

- Lars Seier came from banking with experience building a multi-billion-dollar business.

- Saw decentralized blockchain as a tool to solve real-world problems.

- Banking background shaped his view that:

- Identity is critical for any infrastructure rails.

- Reliability and scalability are mandatory for enterprise adoption.

- Regulation must be considered from the start.

- Seven-year evolution of the landscape

- Global shift toward zero-knowledge proofs (ZKPs).

- Widespread focus on identity.

- Major tech players adopting similar concepts:

- Google integrated ZKP into its wallet.

- Apple rolled out its ID framework.

- Role of the new executive team

- Current team’s mandate is to carry Lars’ original identity-first vision forward.

- Doing so in a timely, strategic, and market-aligned manner.

- Belief that the timing is now optimal given broader industry movement.

- Strategic alignment with real-world needs

- Not an isolated or abstract strategy.

- The world actually needs identity + compliance-ready rails today.

- Concordium positions itself to provide exactly that.

- Host reflection

- Identity layer creates more use cases than other L1s.

- Enables applications that require compliance, such as:

- Panenka

- The Armenian wine cellar project

- Notes that merchants are likely to move to Concordium because these applications cannot exist elsewhere.

- Comments

3 Concordium BFT and Deterministic Finality

3 Concordium BFT and Deterministic Finality

0:00

/198.195011

- Deterministic finality

- Concordium achieves final settlement in 2–4 seconds.

- No need for multiple block confirmations, unlike probabilistic chains.

- No forking

- Chain never forks; instead it pauses if consensus is incomplete.

- Validators wait briefly until majority is aligned; if necessary, sign a timeout.

- Reason pausing matters

- Prevents network splits where different node sets create divergent ledgers.

- Avoids the reconciliation battle that can erase or reverse transactions.

- Rollback prevention

- Because there is no forking, there is no rollback scenario on Concordium.

- Why stablecoin issuers prefer this

- Guarantees irreversible, reliable, predictable finality.

- Eliminates confirmation uncertainty for high-value, high-throughput transactions.

- Ensures responsive payments without delays or spinning indicators.

4 Why PLTs Replace Smart Contracts for Assets

4 Why PLTs Replace Smart Contracts for Assets

0:00

/173.11

- Why smart-contract token models create risk

- Smart-contract tokens centralize all user funds into one contract-managed pool.

- Ledger of individual balances is kept inside the contract logic, not directly on the protocol.

- This creates a single high-value target for attackers.

- Compromising the contract or its internal ledger lets an attacker reassign ownership.

- PLTs: protocol-level security model

- Each user’s PLT remains in their own protocol-level “box”.

- Movement requires the owner’s signature — cannot be reassigned by a contract.

- The only way to break this model is to compromise the entire protocol, not a contract-level vault.

- This shifts risk from a fragile contract to the full security of the network.

- Prevention of fake or spoofed tokens

- Not everyone can issue a PLT; issuers must be approved.

- Eliminates fake or look-alike tokens that rely on similar smart-contract addresses.

- Users cannot mistakenly buy tokens that mimic legitimate assets.

- Key outcome

- PLTs remove the honeypot problem of smart contracts and ensure direct, protocol-level ownership with no internal ledgers or pooled custody.

- Comments

5 How PLT Issuers Are Vetted

5 How PLT Issuers Are Vetted

0:00

/45.74

- Current vetting model

- Vetting is handled by the Concordium Foundation.

- Stablecoin issuers may approach Concordium, or Concordium may approach them.

- Concordium verifies that applicants are legitimate stablecoin issuers.

- Approval Process

- Issuers complete a formal application form.

- The form is reviewed and signed by the EMG (Ecosystem Management Group).

- Once validated, the asset is added through the governance process.

- Outcome

- Only approved entities can issue PLTs.

- Prevents unauthorized or fraudulent tokens from appearing on the chain

6 Why PLTs + Identity Are Unique to Concordium

6 Why PLTs Identity Are Unique to Concordium

0:00

/161.535011

- Identity + PLTs is not a new idea — but Concordium is alone in execution

- Other chains (Stellar, Cardano, Oracle chains) see the value of asset issuance + identity.

- Concordium is the only chain fully committing to this model today.

- Governance-gated issuance

- Only approved projects can become PLT issuers through governance.

- Ensures quality, legitimacy, and prevents uncontrolled asset creation.

- Smart contracts were never meant to be custodians

- Historically designed for automation and efficiency, not asset custody.

- PLTs avoid custodial smart contracts entirely, restoring the original purpose.

- Removes smart-contract value storage — one of the root causes of exploits.

- Synergy: ID at protocol level + protocol-level tokens

- Identity built directly into the protocol aligns perfectly with PLTs at protocol level.

- Creates an offering no other chain currently delivers.

- Performance and reliability advantages

- Concordium delivers:

- Robust consensus

- Deterministic finality

- Stable, predictable fees

- Scalability approaching Mastercard-level throughput

- Concordium delivers:

- Predictable costs

- Peter notes that other chains see fee variability due to smart-contract load and complexity.

- Concordium’s protocol-level PLTs + protocol-level identity result in fixed, predictable fees, ideal for finance and payments.

- Comments

7 How Stable Fees Are Maintained

7 How Stable Fees Are Maintained

0:00

/74.475011

- How the fee peg works

- All fees are pegged to 1 euro cent.

- CCD is the utility token used to pay fees on the chain.

- Conversion mechanism

- Fee calculation converts:

- 1. Energy required for an operation →

- 2. Euro-denominated cost →

- 3. Equivalent CCD amount at current CCD price.

- = Result: fiat cost is stable, CCD amount varies.

- Fee calculation converts:

- Why fee stability holds

- Load on the network does not change the fee.

- Proof-of-stake design avoids gas-market congestion effects.

- Complexity or volume does not generate fee spikes.

- Outcome

- Users and businesses can predict fees precisely in fiat terms, regardless of chain activity.

8 Concordium’s ID Layer and Zero-Access Design

8 Concordiums ID Layer and Zero Access Design

0:00

/179.865011

- Purpose of the integrated ID layer

- Designed to provide user privacy and trust at the infrastructure layer.

- Every user must complete ID verification via trusted ID Providers before creating an account.

- How credentials are handled

- Users submit government ID (e.g., passport, driver’s license).

- These credentials are:

- Stored off-chain by the IDP, and

- Locally encrypted inside the user’s wallet.

- Concordium never has access to personal data.

- Zero-knowledge proofs (ZKPs)

- Allow users to verify specific attributes (age, jurisdiction) without revealing documents.

- Supports privacy while enabling regulatory alignment.

- Benefits for issuers

- Example: a stablecoin issuer can block US persons without viewing documents.

- Enables compliance without data exposure.

- Both user and issuer remain in control of what information is shared.

- Infrastructure value

- Concordium provides the protocol-level rails for ID + ZKP integration.

- Varun hands to Peter for the technical workings.

- Comments

9 How ID Verification Works Technically (Peter’s Walkthrough)

9 How ID Verification Works Technically Peters Walkthrough

0:00

/181.56

- Onboarding with an ID Provider

- User submits an ID photo and a selfie.

- IDP verifies liveness, face match, and authenticity.

- Creation of the verified dataset

- IDP extracts fields: DOB, nationality, name, document number, expiry.

- IDP signs the dataset, confirming verification.

- No data is sent to the chain.

- Local storage + on-chain commitment

- Dataset is returned to the user’s device, stored locally.

- User generates a Pedersen commitment on-chain:

- A mathematical hook to the data.

- Reveals nothing about the underlying information.

- Encrypted using Privacy Guardian keys.

- Integrity + ZKP verification

- If the user alters local data (e.g., DOB), ZKP checks will not match the on-chain commitment.

- Ensures:

- Data cannot be falsified,

- While remaining private and off-chain.

10 ZKP UX, Merchant Benefits, and Compliance

10 ZKP UX Merchant Benefits and Compliance

0:00

/257.460023

- Abstracting the complexity

- ZKP and identity operations are hidden from the user, similar to Web2 UX evolution.

- Users retain control over what they share, without handling technical details.

- User-side benefits

- Users can prove eligibility (e.g., age) without uploading documents.

- Avoids repeatedly submitting passports across multiple sites.

- Preserves privacy and improves experience.

- Merchant-side benefits

- Merchants do not want to store passports due to:

- Data security exposure

- Storage and cybersecurity costs

- Risk of leaks (even large platforms suffer breaches)

- Concordium removes sensitive data custody entirely.

- Merchant only receives a pass/fail attribute check.

- Merchants do not want to store passports due to:

- Compliance advantages

- Merchant can prove verification happened because the check is on-chain and auditable.

- Provides transparency without user data exposure.

- Aligns with growing age-verification and online safety regulation.

- Cost efficiency

- Traditional document-processing flows cost $1–$3 per verification.

- Concordium’s ZKP identity flow costs €0.01 per transaction.

- Makes compliance financially viable even for low-value purchases.

- Ecosystem-wide benefit

- Model is designed to support all stakeholders — users, merchants, and regulators.

- Simplifies onboarding for regulated merchants (e.g., liquor sellers).

- Lets them enforce rules (e.g., “no users under 21”) without managing identities.

- Comments

11 Traction, Stablecoins & Ecosystem Growth

11 Traction Stablecoins Ecosystem Growth

0:00

/180.75

- A strategy only months old

- The PayFi strategy was rolled out at the start of the year.

- Despite being new, growth has been fast and broad.

- Concordium positions itself as a chain with battle-tested tech, now aligned to PayFi.

- Stablecoin momentum

- Over 10 currencies already issued as PLTs.

- Achieved within 6–7 months.

- Major wallet integrations

- Ledger and Bitcoin.com committing to integrate Verify & Pay.

- Gives Concordium access to large global user bases.

- Protocol-level tokens are live

- PLTs are not theoretical — they are active on-chain today.

- Users can already hold and use them in wallets.

- Institutional-grade partners

- One of Europe’s leading money market fund providers (Spiko) working with Concordium on trade finance solutions.

- Real-world deployments

- E-commerce marketplace using Verify & Pay.

- Adult content merchant using Concordium’s ID tech for compliance-grade age verification.

- Legacy ecosystem activation

- Earlier Concordium-era projects (e.g., AesirX, Provenance Tags) are now integrating Verify & Pay and connecting to the new rails.

- Host reflection

- Notes that few chains can show such breadth and variety of real applications so quickly.

12 Tokenized Money Market Funds & Trade Finance Efficiency

12 Tokenized Money Market Funds Trade Finance Efficiency

0:00

/165.84

- Capital inefficiency in trade finance

- Large amounts of capital sit idle or underutilized in trade finance flows.

- Lack of efficiency impacts buyers, sellers, and lenders.

- Inefficiencies in current settlement rails

- International settlements rely on SWIFT, which is outdated for modern commerce.

- Multiple intermediaries add costs and delays.

- Estimated 1–2% loss occurs from time-value of money and intermediary fees.

- When scaled to billions of dollars, even small efficiencies produce large gains.

- Role of tokenized MMFs

- Idle capital locked in trade transactions can earn yield instead of remaining dormant.

- Funds no longer need to be sent days in advance; they can be held until goods are received.

- Capital remains productive until the moment of settlement.

- Concordium’s enabler: locks

- Locks provide the mechanism to enforce conditional, time-based, or state-based fund release.

- Allow a tokenized MMF to function seamlessly within trade finance flows.

- Sets up the explanation for Peter to dive into locks in the next section.

- Comments

13 Locks: Scheduled Release & Protocol-Level Safety

13 Locks Scheduled Release Protocol Level Safety

0:00

/166.740658

- Locks existed from the beginning

- Concordium has always supported scheduled release:

- Funds can be sent, kept locked, and then released on a defined schedule.

- Entire flow is handled in one transaction.

- Concordium has always supported scheduled release:

- Motivation for enhancement

- With the arrival of PLTs, the team sought to extend the lock mechanism.

- Aim: expand use cases while keeping the same security principles.

- Why Concordium’s locks differ from other chains

- On most chains, locks are implemented via escrow smart contracts, creating:

- A honeypot holding user funds.

- Targetable vulnerabilities.

- Concordium rejects this model to preserve its protocol-level custody approach.

- On most chains, locks are implemented via escrow smart contracts, creating:

- Protocol-level lock design

- Funds remain in the user’s own account — they never move into a smart contract.

- A lock flag prevents the sender from spending the funds.

- The receiving party can see that the funds are locked and will be released when conditions are met.

- Aligns with Concordium’s principle:

- Tokens stay with the user.

- Security at protocol level, not contract level.

- Capital efficiency preserved

- Because the funds stay in the user’s custody, any yield (e.g., from tokenized MMFs) accrues to the holder, not to a contract.

- Locks enable conditional delivery without sacrificing yield.

- Next steps

- Enhanced lock functionality will be released imminently on DevNet.

- Host responds positively, framing locks as a strong mechanism for capital efficiency.

- Comments

14 KPIs and Momentum Indicators for Concordium

14 KPIs and Momentum Indicators for Concordium

0:00

/198.075011

- No single metric — focus on momentum

- Concordium does not rely on one KPI.

- Industry conditions shift rapidly, so success is measured through momentum across several dimensions.

- 1. Ecosystem growth

- Continued expansion of:

- Partners

- Enterprises

- Stablecoin issuers

- The pipeline is strong, with additional integrations expected (not yet announced).

- Continued expansion of:

- 2. Scaling One-Click Verify & Pay

- Concordium ID adoption expected to scale significantly.

- Mobile app already live on App Store and Google Play.

- Major unlock: Ledger and Bitcoin.com integrations going live soon.

- Their user bases will immediately gain access to Verify & Pay.

- 3. Wallet evolution

- Concordium Wallet receiving major upgrades in:

- Feature set

- Usability

- User experience

- By 2026, the wallet could be strong enough for users to question the need for Apple Pay or Google Pay.

- Concordium Wallet receiving major upgrades in:

- 4. Builders & real use cases

- 2025 was focused on laying foundations:

- Exchanges

- Third-party wallets

- Stablecoin issuers

- With foundations in place, 2026 will bring:

- More builder activity

- More deployed use cases

- Rollout of new applications starting Q1

- 2025 was focused on laying foundations:

- 5. Accessibility & liquidity expansion

- Continued improvements in accessibility.

- More exchange listings expected as part of scaling the ecosystem.

- Comments

15 Protocol 10 Preview & Sponsored Transactions

15 Protocol 10 Preview Sponsored Transactions

0:00

/135.765011

- Context: major progress already delivered

- Significant advancements made since early in the year across:

- Core protocol and chain

- Identity app

- Wallet-related features

- Significant advancements made since early in the year across:

- Upcoming identity app upgrades

- New features coming soon, including:

- ZKP execution directly from the identity app

- Enables ZKP flows even when using third-party wallets.

- New features coming soon, including:

- P10 DevNet launch

- Protocol 10 DevNet is launching soon.

- Two headline capabilities highlighted:

- 1. Sponsored transactions

- Merchants will be able to hold CCD and pay gas on behalf of users.

- Users paying with stablecoins/PLTs will not need to hold CCD.

- Enables:

- Frictionless one-click Verify & Pay

- Simpler UX: scan QR → verify → pay

- No second-currency complexity.

- 2. Enhanced locks

- P10 also delivers the new lock mechanism discussed previously.

- Will support a wide range of flexible, condition-based use cases.

- Partners will begin testing how locks integrate with PLTs and capital-efficient flows.

- 1. Sponsored transactions

- Overall readiness

- P10 combines:

- Sponsored transactions

- New locks

- Identity app upgrades

- Resulting in a more flexible, safe, and commercially deployable PLT environment.

- P10 combines:

- Comments

16 Advanced Lock Use Cases & Safe Smart-Contract Triggers

16 Advanced Lock Use Cases Safe Smart Contract Triggers

0:00

/210.24

- Balancing flexibility with protocol-level safety

- Lock-related use cases can become very complex quickly.

- Concordium’s approach:

- Keep the chain fast, scalable, and secure.

- Maintain protocol-level custody for user funds.

- Push complexity to where it belongs: smart-contract triggers, not vault-like custody contracts.

- Division of responsibilities

- Protocol level (the lock):

- Funds stay in the user’s wallet.

- A lock prevents spending until conditions are met.

- Ensures PLT safety and removes honeypot risk.

- Smart contract layer (the trigger):

- Manages conditions:

- Oracles

- Multi-party signatures

- Conditional approvals

- Unlock limits or partitions

- Any arbitrary business logic

- BUT: the smart contract can only do one of two things:

- Release funds in the intended direction, or

- Cancel the lock and return funds to the owner.

- Manages conditions:

- Protocol level (the lock):

- Security implications

- Even if a smart contract was compromised:

- The attacker cannot redirect funds to themselves.

- They can only trigger the intended release or a return.

- In PayFi, parties know each other, so accidental outcomes are easily resolved (e.g., “you received the release, send it back into a new lock”).

- Even if a smart contract was compromised:

- Emerging real-world use cases

- E-commerce refunds:

- If goods never arrive, funds simply unlock back to the buyer.

- No need to call a bank or dispute a charge.

- Rental deposits:

- Deposit remains in the tenant’s wallet, earning yield.

- Landlord sees the locked amount and knows it’s guaranteed.

- A third party could adjudicate damages by triggering release or return.

- Escrow-type flows without escrow custody:

- Smart-contract logic governs outcomes; custody remains with the user.

- E-commerce refunds:

- Momentum and anticipation

- Confirms these use cases will begin materializing with DevNet P10 and the 2026 rollout.

- Comments

17 Competing With Apple/Google Pay Through Privacy & Infrastructure

17 Competing With Apple Google Pay Through Privacy Infrastructure

0:00

/216.705011

- The competitive frame

- Concordium is not only competing with blockchains but also with Apple Pay and Google Pay.

- Host asks what differentiates Concordium enough to challenge these giants.

- 1. Core differentiator: user data belongs to the user

- Google Pay model: “All your data belongs to Google, and they will use it.”

- Apple Pay model: “All your data belongs to Apple — they won’t sell it, but they will use it.”

- Concordium model:

- User data belongs to the user.

- User remains fully in control.

- Concordium provides infrastructure without ever compromising privacy.

- 2. Stablecoins are already massive — but not used for payments

- Last 12 months: ~$7 trillion in stablecoin volume.

- Only 1% used for actual payments.

- Why adoption for payments is low:

- No reliable identity framework

- No compliance readiness

- No predictable cost structure

- Limited merchant trust

- 3. Concordium enables stablecoins as payments infrastructure

- Stablecoins are inherently:

- Faster

- Cheaper

- More efficient

- Concordium adds what the ecosystem is missing:

- Verified identity

- Compliance-grade rails

- Stable fees

- Deterministic finality

- Merchant + UX simplicity (Verify & Pay)

- Stablecoins are inherently:

- 4. Practical global payment use cases

- Examples Concordium can enable:

- Everyday purchases (e.g., coffee)

- High-value transactions (e.g., mortgages)

- Cross-border transfers (e.g., sending money home to family)

- At a fraction of the traditional 4–5% cost

- And well below FinTech rails’ 1–2% fees

- Examples Concordium can enable:

- 5. Result: a credible alternative to Apple/Google Pay

- Concordium combines:

- Stablecoins

- Regulatory trust

- Identity

- Protocol-level security

- Simple user experience

- Creates a payment experience large enough and reliable enough to compete with global incumbents.

- Concordium combines:

- Comments

18 Regulation, Compliance, and Staying Ahead of Burden

18 Regulation Compliance and Staying Ahead of Burden

0:00

/107.775011

- Regulatory context

- The host raises the issue of regime risk as Concordium targets regulated finance and identity.

- Asks how Concordium stays ahead of regulatory burden given its strong compliance posture.

- 1. Regulation’s purpose: protection

- Regulation exists to protect users and safeguard interactions.

- Traditional compliance often forces users to give up all their personal information, which creates privacy trade-offs.

- 2. Concordium’s infrastructure reduces that burden

- Concordium enables compliance without exposing personal data.

- Identity verification and required attributes can be proven privately, ensuring:

- Compliance

- Safety

- Minimal data disclosure

- No central corporate data harvesting

- 3. Adaptability to future regulation

- Concordium can adapt and modify components of the system as regulations evolve.

- But it will maintain its core principle:

- User privacy remains intact

- Identity stays in the user’s control

- 4. Upcoming enhancements to the ID layer

- Major advancements to Concordium’s ID layer are planned for the coming year.

- These upgrades strengthen the chain’s ability to meet evolving regulatory identity requirements.

- Public details will be shared as they’re finalized.

- Comments

19 Path to Decentralization & Governance Committee Expansion

19 Path to Decentralization Governance Committee Expansion

0:00

/118.845011

- Host’s question

- Refers to Concordium’s original three-phase decentralization plan outlined in the whitepaper.

- Asks whether Concordium is still on track to achieve a fully community-elected Governance Committee (GC) and whether current developments hinder that plan.

- 1. Decentralization process already underway

- Elections have already begun.

- New members have been elected to the Governance Committee.

- The process will continue and expand as the ecosystem grows.

- 2. Future state: increasing decentralization

- As more users, builders, and stakeholders join the ecosystem, GC elections will become:

- More decentralized

- More representative

- More community-driven

- Voting power and governance decisions will increasingly be in the hands of the community.

- As more users, builders, and stakeholders join the ecosystem, GC elections will become:

- 3. Alignment with original intention

- The phased approach was always designed to start centralized for safety.

- This ensures the protocol can evolve securely during rapid growth and change.

- The team remains committed to the long-term decentralization roadmap.

- 4. Timing considerations

- Decentralization may be happening slightly slower than originally planned due to:

- The volume of ongoing upgrades

- The need to maintain safety while making major changes

- But the direction is clear:

- Decentralization is progressing

- No deviation from the intended approach

- Decentralization may be happening slightly slower than originally planned due to:

20 Travel Rule, KYC-as-a-Service & Proof-of-Human

20 Travel Rule KYC as a Service Proof of Human

0:00

/187.74

- Host’s question

- Asks how Concordium is positioned for:

- Travel Rule compliance

- KYC-as-a-Service

- Broader regulatory headwinds/tailwinds

- Wonders whether these are natural extensions of Concordium’s identity-first design.

- Asks how Concordium is positioned for:

- 1. Travel Rule alignment

- Concordium already works with an IDP deeply established in the Travel Rule sector.

- Integration work is ongoing to make Travel Rule capabilities natively available on-chain.

- Travel Rule requirements (“trace where funds come from and where they go”) align naturally with Concordium because:

- Every account is linked to a verified identity.

- The chain natively knows the sender and receiver.

- Concordium’s architecture inherently satisfies the Travel Rule’s core principle.

- 2. KYC-as-a-Service potential

- Concordium’s structure already provides the necessary components:

- An identity-bound account

- ZKP-based attribute verification

- Privacy-preserving QR-based verification flows

- Users could allow third parties to rely on their pre-verified identity without re-uploading documents.

- Concordium can enable KYC flows without users repeatedly performing full verification.

- Concordium’s structure already provides the necessary components:

- 3. Identity reuse with full user consent

- Identity data stays private, off-chain, and under user control.

- Concordium enables a model where:

- Users consent to verification

- Third parties receive only what is required, via ZKPs

- No central corporate entity accumulates user data

- 4. Proof-of-Human implications

- Because every account must be linked to a verified human identity, Concordium naturally deters:

- Sybil attacks

- Bot activity

- Fake accounts

- Host notes Concordium provides a “proof of human” environment as the crypto industry grapples with identity fraud, bots, and “dead internet” concerns.

- Concordium delivers this without removing privacy.

- Because every account must be linked to a verified human identity, Concordium naturally deters:

- 5. Strategic timing

- Identity, Travel Rule compliance, and proof-of-human are converging exactly as Concordium rolls out these capabilities.

- Team signals more developments coming: “watch this space.”

- Comments

21 Final Question: What Varun & Peter Look Forward to Most

21 Final Question What Varun Peter Look Forward to Most

0:00

/342.381156

- Host’s final question

- Asks what Varun and Peter personally look forward to most in Concordium’s future.

- Invites them to name the use case, upgrade, or goal that motivates them daily.

- Peter’s answer — One-Click Verify & Pay

- His focus remains what he stated in his first town hall: one-click Verify & Pay.

- Represents:

- A large set of technical achievements underneath

- Seamless UX

- Trust + payment + identity in one action

- Upcoming features (locks, PLTs, protocol enhancements) all strengthen this capability.

- Most excited to see new use cases adopting one-click Verify & Pay.

- Varun’s answer — Delivering the original real-world vision

- Concordium wasn’t built to chase Web3 hype; it was built to solve real-world problems.

- Varun’s excitement comes from:

- Implementing the original vision Lars Seier Christensen conceived

- Seeing Concordium become a chain for actual adoption, not speculation

- Moving beyond the industry’s hype cycles (memecoins, trends)

- Notes Web3’s stagnation:

- ~5 billion people online

- Only ~10 million monthly active blockchain users

- That number hasn’t grown meaningfully

- Real opportunity is bringing Web2 users and real-world applications on-chain.

- Key themes Varun highlights

- 1. Execution over noise

- Team stays focused on delivery, not hype

- 2. Not a speculator chain

- Concordium is for durability, utility, and real enterprise use.

- 3. Unique on-chain capabilities

- Identity frameworks

- Protocol-level tokens (PLTs)

- Reliability, finality, and compliance foundations

- 4. Enterprise readiness

- Corporations are finally excited about blockchain.

- Concordium matches needs: reliability, scale, privacy, trust

- 5. Scalability

- Concordium can already scale toward Mastercard-level throughput, not theoretical TPS figures.

- All of this is delivered in a decentralized, trustless, privacy-protecting system.

- 1. Execution over noise

- Comments

- https://t.me/c/1659427635/37946