Verified Finance for the Next Era of Digital Trust

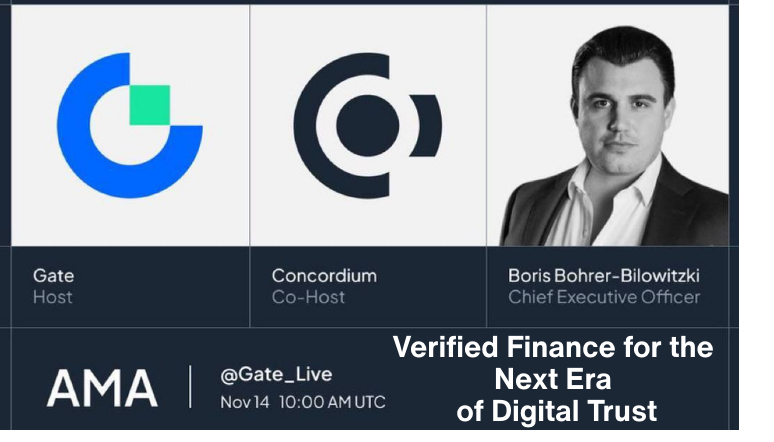

On November 14 2025, Concordium CEO Boris Bohrer-Bilowitzki joined Gate.io for an in-depth AMA discussing the future of blockchain adoption, compliance-first stablecoins, and why Concordium is built for what’s coming next. This summary breaks down all key insights, question by question, bullet by bullet. Dive in and get up to speed in minutes.

1. Who is Boris and what is Concordium building?

1 Who is Boris and what is Concordium building

0:00

/257.900023

- CEO of Concordium, former founding partner of Copper (custodian/prime broker)

- Believes in Satoshi’s P2P payment vision, but sees Bitcoin diverging

- Regulation (KYC/AML) is inevitable — can’t ignore compliance

- Concordium = L1 built for “PayFi” (payments + programmable finance)

- Core USP #1: Protocol-level identity using ZK for privacy + accountability

- Core USP #2: Protocol-level tokens (PLTs) to eliminate smart contract custody risk

- Not competing with Ethereum/Solana — avoids DeFi hype and meme coins

- Targets stablecoin issuers and real-world users, not crypto-native tribes

- Comments

2. What makes Concordium unique among L1 blockchains?

2 What makes Concordium unique among L1 blockchains

0:00

/694.905011

- Most L1s fight over the same small DeFi-native user base

- Concordium targets new users from Web2 — not existing crypto tribes

- Built-in identity (ZK-based) ensures privacy and regulatory compliance

- Focused on real use cases like age-gated payments (gambling, adult content, etc.)

- Offers native token issuance (PLTs) without smart contracts — no honeypots

- Positions itself outside the “alt L1” wars — avoids hype, builds infra for scale

- Stablecoin issuers can hardcode recipient requirements (e.g. 18+)

- Concordium’s philosophy: blockchain should be used, not understood

- Comments

3. Why do privacy and compliance both matter for adoption?

3 Why do privacy and compliance both matter for adoption

0:00

/280.395011

- Concordium created Verify & Pay and Verify & Enter frameworks

- Enables privacy-preserving, age-verified stablecoin transactions

- Partners include Ledger (7.5M users) and Bitcoin.com (75M wallets)

- Use case: compliance with age verification laws (UK, US, EU, LatAm)

- Already live with first UK pilot: Armenian Wine Cellar (alcohol store)

- Demand spans adult content, gambling, dating, and e-commerce

- Regulatory bodies say Concordium offers “the best solution so far”

- These sectors see ~20 billion monthly visits vs. 5–10M DApp users

- Comments

4. How does Concordium enable trust and transparency in finance?

4 How does Concordium enable trust and transparency in finance

0:00

/284.970862

- Stablecoins face regulatory pressure: AML, KYC, and identity required

- Users want privacy, but regulators require traceability — Concordium balances both

- Identity is built into L1, not added via smart contract or third-party layer

- Concordium offers stable, fiat-pegged fees (e.g. $0.01 or $0.00 for Visa)

- Supports high throughput and fork-free consensus — needed by enterprises

- Removes smart contract risk — all features are native to the L1

- Enables verified users, geo-fenced access, and age-gated payments

- These traits are critical for institutional and real-world financial adoption

- Comments

5. What milestones has Concordium achieved and what’s next?

5 What milestones has Concordium achieved and whats next

0:00

/159.38

- Concordium tech has existed for over 4 years; battle-tested through a full bear market

- New leadership and strategy reshaped the organization 6–8 months ago

- Signed 10+ stablecoin issuers across USD, EUR, GBP, CHF, SGD, AED — including MiCA-compliant tokens

- Formed a major partnership with Spiko, Europe’s largest tokenized money market fund

- Introducing a yield-bearing escrow model for trade finance — boosting efficiency by ~5%

- Focus is on long-term infrastructure, not short-term hype

- Still early: “we were nobody, and people still don’t know us — but we’re getting known”

- Comments

6. What is Spiko and why is it so important?

6 What is Spiko and why is it so important

0:00

/305.190023

- Most stablecoins today serve only 3 limited purposes:

- 1. Buy BTC with USDT (retail on-ramps)

- 2. Use as collateral in derivatives

- 3. Yield farming / DeFi “money Legos”

- Tokenized money market funds (like Spiko) offer a real-world yield-bearing use case — but lack adoption due to:

- No distribution layer

- No secondary market

- Regulatory onboarding barriers (e.g. KYC, $100k minimums)

- Spiko is solving this by:

- Partnering with Concordium to unlock compliant access

- Enabling trade finance via programmable, yield-bearing escrow

- Escrow payments can now earn ~4.5% yield instead of paying banks 1.5% fees

- Boosts transaction economics by ~5–6%

- First live tokenized escrow use case expected in early 2026 (not billions yet, but massive potential)

- Boris frames it as:

- “If you’re thinking TVL — this is how you get TVL.”

- Use cases extend down to everyday logic: why pay upfront for a pizza you haven’t received?

- Comments

7. How is Concordium solving compliance, analytics, and Travel Rule?

7 How is Concordium solving compliance analytics and Travel Rule

0:00

/117.735011

- Key milestone: Ledger + Bitcoin.com integrations → access to ~100 million users

- These wallets + others (still unannounced) = distribution layer into Concordium ecosystem

- On/off-ramps:

- Integrated with Transak and banks

- Enable fiat-crypto bridging directly within Concordium

- Compliance & analytics capabilities now in place:

- TRM, Chainalysis, etc. for AML & transaction monitoring

- Support for on-chain analytics

- Travel Rule compliance is solved natively at issuance level

- No smart contract complexity

- No need for post-hoc tools or Satoshi tests

- All of the above implemented in <8 months under new strategy

- Comments

8. What is the long-term vision for the CCD token?

8 What is the long term vision for the CCD token

0:00

/137.16

- CCD is the gas for the entire Concordium ecosystem

- Long-term vision: adoption by major Web2 industries

- Utility of CCD remains unchanged — required to interact with the protocol

- Growth in ecosystem = increased demand for CCD

- Concordium is working to make transactions:

- Cheaper at scale

- Faster (finality to improve beyond current 2–3 seconds)

- No changes in token mechanics expected; focus is on adoption

- Comments

9. How does Concordium balance privacy with regulation?

9 How does Concordium balance privacy with regulation

0:00

/307.280023

- Full anonymity in regulated financial services is not realistic in the coming decades.

- Concordium’s model: KYC once, then reuse identity without exposing personal information again.

- Users interact through zero-knowledge proofs that reveal only required attributes, not identity details.

- Identity is verified once, then preserved privately during all subsequent interactions.

- Concordium’s cryptographic stack was designed by leading researchers (e.g. Damgård, Pritz, Pedersen).

- Concordium enables privacy while still meeting basic KYC and AML requirements at protocol level.

- Identity remains under user control; attributes are not shared with third parties.

- Concordium is the only project offering both compliance and full privacy preservation in a unified system.

- Large incumbent chains and institutions cannot pivot to this model due to structural and regulatory constraints.

- Concordium positions this privacy–compliance balance as the foundation for long‑term sustainability.

- Comments

10. Is there a final message Boris wants to share?

10 Whats your final message for the community

0:00

/126.818526

- Boris encourages listeners to deeply question what real-world blockchain adoption requires.

- He argues most chains won’t succeed unless they rethink their tech stack and compliance model.

- Real adoption is happening — but only with projects tackling hard, structural problems.

- Concordium has been built with these challenges in mind and is now emerging to solve them.

- Comments